The Magnificent Seven are the group of mega cap stocks – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla – that have dominated the global market over the last few years. The catchy wordplay refers to the title of the 1960 Western about seven American mercenaries fighting in a foreign land. While the protagonists’ gunslinging prowess and tough-guy heroics are no doubt what inspired the comparison, one should also note how The Magnificent Seven ends: the heroes move on, admitting their ultimate transience in a world that is changing without them.

Since the Russian invasion of Ukraine in 2022, geopolitical risks have impacted global activity and inflation. This resulted in lower consumer sentiment and higher commodity prices. To bring inflation under control, central banks globally hiked interest rates. The tighter financial conditions bruised markets. As the year-end approached, artificial intelligence came into focus. The companies that monopolised the world’s attention with new technologies, strong earnings, and attractive balance sheets took on the Magnificent Seven moniker. They are all great brands with powerful visions that have the means to invest heavily in AI infrastructure, and the potential to use it effectively.

The world of artificial intelligence today feels like a frontier town back in the American Wild West. The atmosphere is thick with danger, opportunity, and the sense of the unknown. The AI initiatives developed in recent years have largely had little regulatory oversight. In the pursuit of great wealth, companies are racing to outpace each other, often ignoring personal and public safety.

But we have seen some signs that the Magnificent Seven stocks may be losing their shine. While the rally in the seven stocks dominated markets in 2023 and into the first half of this year, the euphoria surrounding them lifted the bar higher and higher, setting them up against unrealistic short-term earnings expectations. Unable to deliver perfection, the stocks saw a sell-off in July with some investors doubting whether they could continue at the same pace. Nothing lasts forever, as the adage goes.

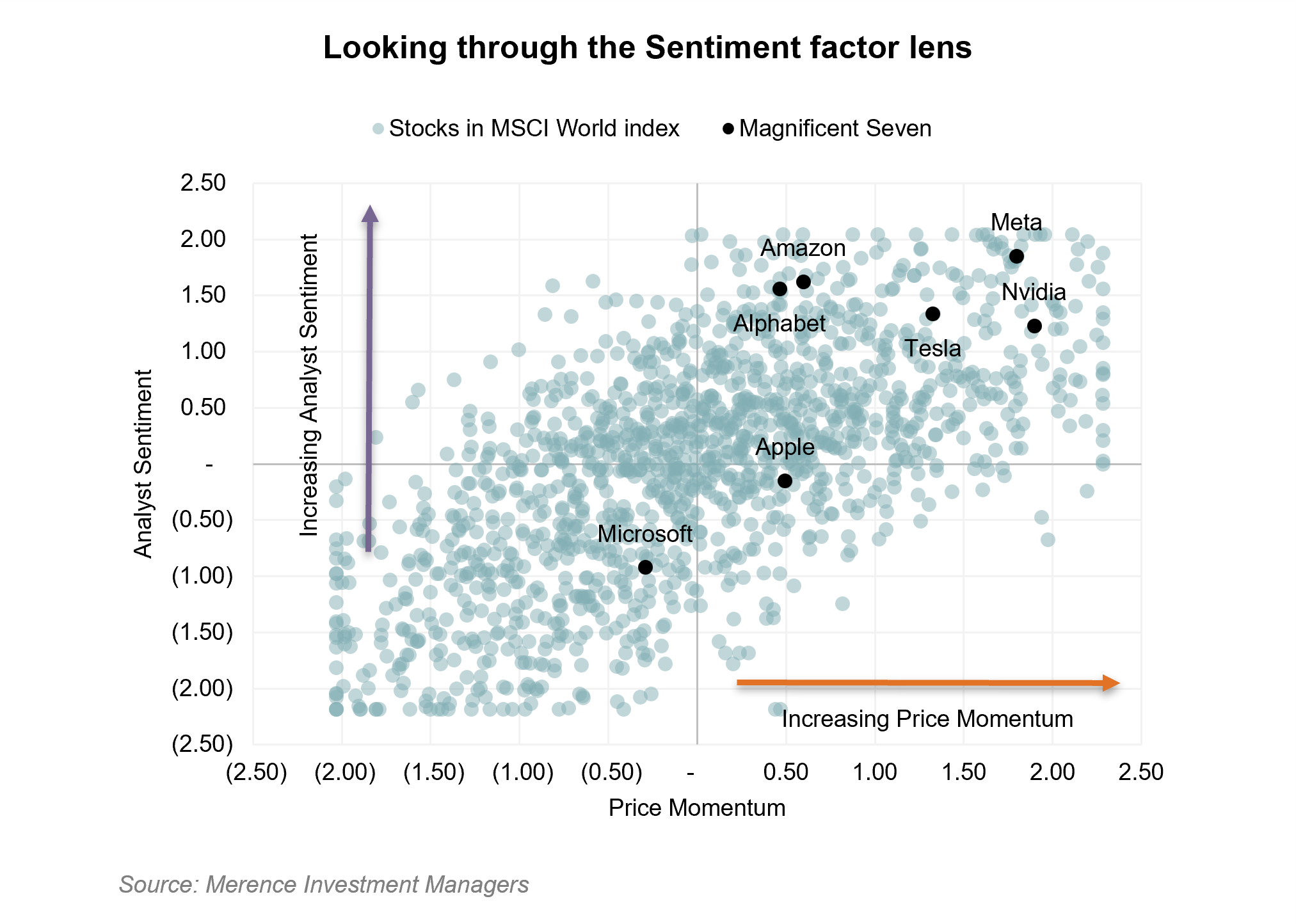

Cooling inflation and the start of the interest rate cutting cycle have drawn investor attention to the wider market. The chart below looks through our Sentiment factor lens, comparing sentiment in the Magnificent Seven to the broader MSCI World (developed market) index.

Looking at the chart, most of the Magnificent Seven are in the top right quadrant. In other words, they score favourably on both price momentum and analyst sentiment relative to the market. However, some have recently shifted left, indicating a decrease in price momentum. Microsoft has fallen behind the pack.

Perhaps the most contentious of the seven has been Tesla. Against the backdrop of an increasingly competitive global electric vehicle market, Tesla stock has been highly volatile and trailed behind. Its sentiment positioning versus the others lagged for most of this year. Tesla has moved sharply positive recently. However, this is not due to fundamentals or stability in earnings, but speculation around the US elections. Donald Trump’s win has led to a surge not just of Tesla’s stock price, but also the likes of Bitcoin, and meme stocks.

The question on everyone’s mind is, will the Magnificent Seven stocks continue to monopolise markets, or will they lose their bluster, their influence fade, and instead, like the gang at the end of The Magnificent Seven, become obsolete?

Overall, we see a fade in sentiment, but the dominant theme is still largely in place. The Magnificent Seven remain popular as almost everyone still holds them. The seven stocks represent as much as 32% of the S&P 500 and 23% of the MSCI World index today. These are significant statistics, and price creates its own momentum.

So, what would trigger a larger structural selloff? An alternative. An idea big enough to take its place. Right now, there are no compelling narratives that present us with the next best thing. What may lead investors to sell aggressively is a recession and signs of capital spending in AI starting to slow. That may be what ultimately tests the Magnificent Seven. For now, however, the sun is yet to set in the Wild West of artificial intelligence.

Our Market Snippets aim to provide concise insight into our investment research process. Each week, we highlight one chart that showcases our research, motivates our current positioning, or simply presents something interesting we’ve discovered in global financial markets.

For more of our current market views, please visit our website.