This week my kids put up our Christmas tree and decorations, which means it is beginning to look a lot like the time of year that every second fund manager writes an article about the potential for a Santa Rally into year end. So I thought I’d get mine out of the way.

The Santa Rally is the claim that equity markets tend to drift higher over the year-end holiday period. It is part of the broader category of seasonal effects, theories that certain financial assets perform better or worse at set times of the month, year, or decade. Calendar effects are seductive in their simplicity; can I really add outperformance just by considering the date on which I take a position? But they also face many criticisms from sceptics. One of them is data overfitting. While a simple back test bears out the Santa Rally phenomenon, this could just be due to overfitting and a hindsight bias. If I test enough different seasonal effects, I will find one that looks good by chance.

My test showing the statistical significance of the Santa Claus Rally has far less meaning if I previously and unsuccessfully tested The Valentines Indicator, Get Long on Guy Fawkes, and the Diwali Strategy. The answer to this risk of data mining is to run an out-of-sample test, a test of the hypothesis on never-before-seen data. In November 2012, I wrote an article on this very effect.

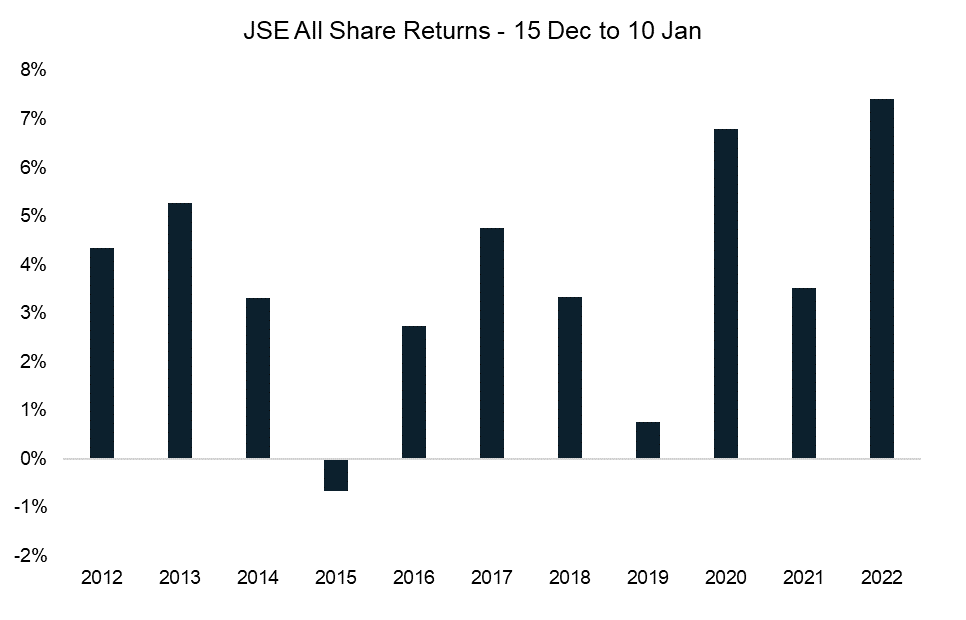

The data up until then suggested evidence of a year-end rally effect for the JSE. The advantage of revisiting this is that the eleven years since then now offer an out-of-sample test of sorts. If the data over the decade after a claim is made bears out the claim, this result is less likely due to overfitting.

Source: Mergence Investment Managers

Measuring the performance of the JSE All Share over the period from the 15th of December to the 10th of January, the table above shows that this effect has been strong over the past 11 years. 10 out of these eleven years have experienced positive markets, and the average return of the market over these four or so weeks has been 3.8%.

Does this conclusively prove this effect? No, it could still just be a coincidence, and there is no guarantee that this effect will persist in the future. But it should increase our confidence in the phenomenon at the margin. We do take some of these types of effects into account in our multi-asset investment process, but their influence is appropriately weighted relative to other models that we believe have a much larger explanatory power and more sound economic rationale.

Our Market Snippets aim to provide concise insight into our investment research process. Each week, we highlight one chart that showcases our research, motivates our current positioning, or simply presents something interesting we’ve discovered in global financial markets.

For more of our current market views, please visit our website.