Weak economic data and volatility in risk assets over the past week have increased expectations of an imminent Fed rate cut. In this short note, we examine the impact of the Fed’s monetary policy cycle on the gold price to determine whether the next cutting cycle is likely to support gold or if this effect is already priced in. For context, simply going long on stocks or bonds when the Fed is cutting rates and selling them when rates are rising has not historically been a productive strategy. It appears that the bond market anticipates the Fed cycle in advance, and for equities, the relationship is non-linear – sometimes a Fed cut is positive, but other times it is in response to a growth shock and therefore negative.

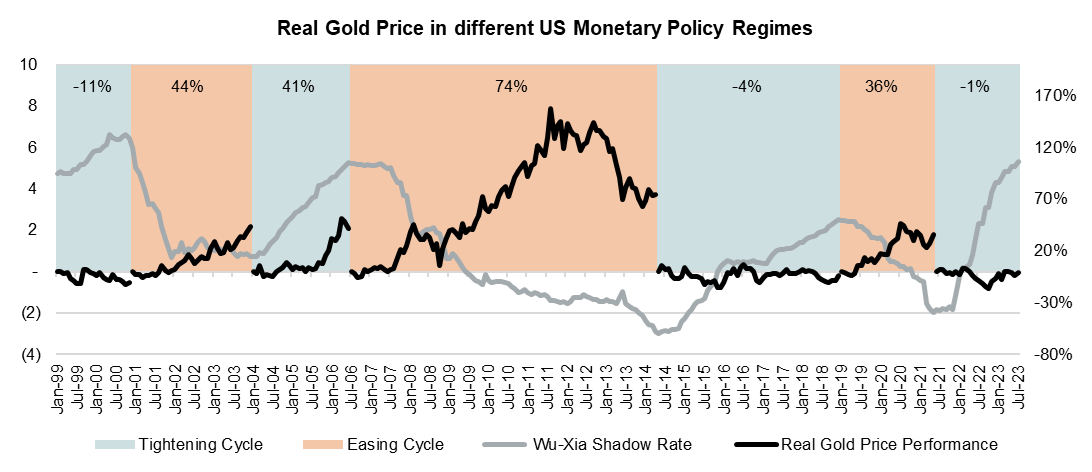

To test this, we have used the Wu-Xia Shadow Fed Funds rate to capture the effect of Quantitative Easing (QE) and Tightening (QT) in addition to monetary policy changes. This series is equal to the Fed funds rate when rates are positive but attempts to estimate the effect of QE to get an interest rate equivalent to this non-conventional monetary policy effect when the target rate is zero. This results in a negative value for the Wu-Xia rate over that time. We use this to split the last 35 years into periods of rising, falling or flat Fed funds rate and test the performance of the real gold price in these periods. We use the monthly change in the real gold price to try and normalise for the effect of different inflation regimes.

The results are below, showing a strong relationship between the US monetary policy cycle and the performance of the gold price, suggesting that the gold price does not entirely price in the monetary policy effects of the rate cycle before it happens. An important caveat to this approach is that while we have 35 years of data, this really only gives us seven monetary policy cycles to analyse, which reduces the true statistical significance of any testing over this period.

Of course, this is only one factor and central bank buying, geopolitical risk, etc. could all play an important role driving the gold price. Another counter argument is that while the gold price has on average outperformed in previous cutting cycles, many of these cycles were not as well expected as the current one. This may mean that while the gold price doesn’t always price in monetary policy changes before the fact, it may have done so for the upcoming cycle.

Our Market Snippets aim to provide concise insight into our investment research process. Each week, we highlight one chart that showcases our research, motivates our current positioning, or simply presents something interesting we’ve discovered in global financial markets.

For more of our current market views, please visit our website.