This week, the US Federal Reserve’s Federal Open Market Committee (FOMC) kept US interest rates unchanged but published an update to the dot plot, the forecast by FOMC members of interest rate policy. The Fed introduced the dot plot in 2012 and updates these projections on a quarterly basis.

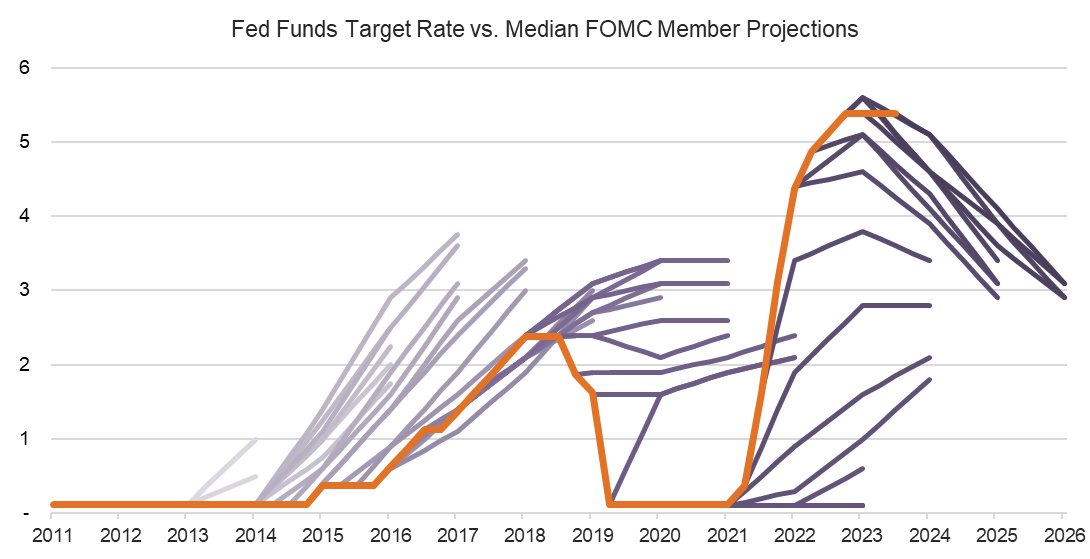

The market pays a lot of attention to these forecasts, with changes to the dot plot often driving equity and bond market reactions. But how accurate have the Fed’s projections been in the past, and can we draw any conclusions from this track record for future policy decisions? The chart below shows these projections versus the actual progression of the Fed funds target rate since 2011.

Source: US Federal Reserve

Now, while we have almost 15 years of this data, this period only covers three rate cycles, limiting the robustness of the conclusions we can draw. Nevertheless, the Fed’s own projections were too early for the 2015–2018 hiking cycle.

The Fed did not anticipate the 2020 cutting cycle, but this is understandable given the large influence of the COVID pandemic on this cycle. While the Fed’s forecasts got the direction of the 2022 hiking cycle correct, they underestimated the speed of the hikes. Again, it looks like the Fed has been early in forecasting the current cutting cycle. But while the dot-plot forecasts have historically missed the speed of rate changes, they seem to have been directionally right quite often.

Currently, the median FOMC member expects the Fed funds rate to only decline by 25 basis points this year, but to reach 3.1% by the end of 2026 and to average 2.8% thereafter.

Absent any unforeseen shocks to the economy, we think that the Fed has the direction right, and rates are going to moderate over the next few years.

Our Market Snippets aim to provide concise insight into our investment research process. Each week, we highlight one chart that showcases our research, motivates our current positioning, or simply presents something interesting we’ve discovered in global financial markets.

For more of our current market views, please visit our website.